Europe’s diesel market is starting to spike, underscoring its vulnerability to supply disruptions since cutting off imports from top supplier Russia earlier this year, according to Bloomberg.

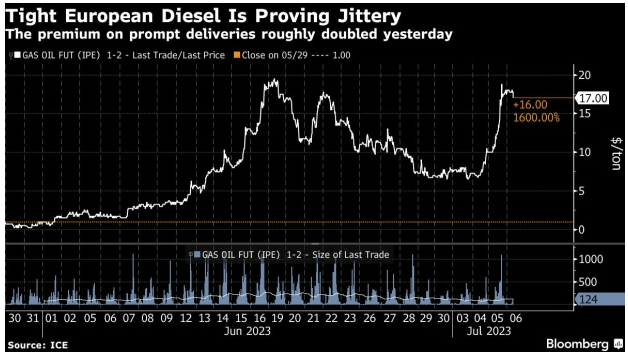

Premiums for immediately-available supplies surged on Wednesday, data from ICE Futures Europe show, indicating that traders perceive the physical market to be tightening.

There were a few refinery disruptions in Germany this week, as well as lower levels of imports from the Persian Gulf — one of the key alternative suppliers since the European Union banned imports from Russia on February 5.

“The front spreads jumped yesterday on prompt supply concerns due to a number of European refinery outages and a drying up of available volumes out of the US Gulf Coast that could provide a relatively quick resupply,” Philip Jones-Lux, commodity owner at Sparta Commodities, said by email.

With flows from the Middle East and other suppliers East of Suez constrained at the moment, and some volumes on water only expected to arrive toward the end of July, there is a need to entice more volumes out of storage in the short term, he said.

Inventories of diesel and heating oil in independent storage in northwest Europe slid in June below the 5-year seasonal average level.

There have been refinery outages in the Netherlands, Germany, and Romania over the past several weeks weeks that have disrupted supply.