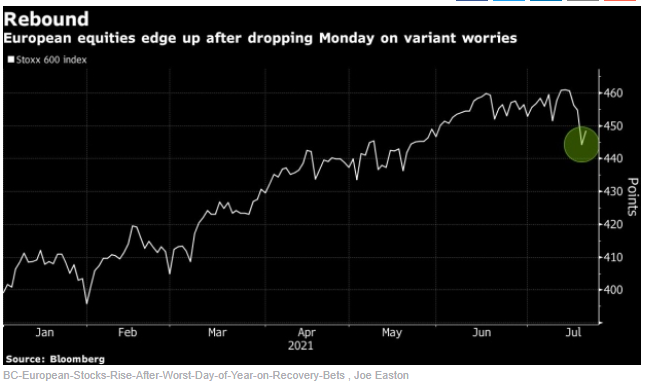

European stocks gained after their worst day in seven months as optimism over economic growth and earnings prospects outweighed concerns around the spread of Covid-19 variants, according to Bloomberg.

The Stoxx Europe 600 Index was up 1% at 8:14 a.m. in London, with cyclical sectors like financials and miners outperforming, while energy shares got a boost from crude futures. Defensive stocks like health care and utilities underperformed. This is a reversal of Monday’s declines when more economically sensitive industries led to the drop.

“The stock market should continue to advance in the coming years, primarily driven by earnings growth,” said global strategist at JPMorgan Private Bank, Madison Faller.

“Even if case counts do get substantially worse before they get better, hospital utilization rates remain far lower than where they were at the peak of the Covid crisis, which matters a lot for the reopening,” said Faller.

The Stoxx 600 benchmark lost 2.3% on Monday, the most since December, as rising coronavirus infections spurred fresh worries about business disruption. However, despite concerns over elevated equity valuations, investors see few alternatives to stocks as bond yields remain depressed.

Earnings are a big focus for investors as companies ramp up reporting this week. Market participants will be watching profit and outlook updates to gauge the strength of the recovery and corporate optimism.

Among individual stocks moving on Tuesday, UBS Group AG rose 4.3% after posting better-than-expected second-quarter profit, while cautioning that client activity is set to slow down. EasyJet Plc added as much as 4.2% after posting a smaller-than-expected pretax quarterly loss.

Wm Morrison Supermarkets Plc slipped 0.5% amid news that Apollo Global Management Inc. is in talks to join forces with Fortress Investment Group’s 6.3 billion-pound ($8.6 billion) bid for the grocer.