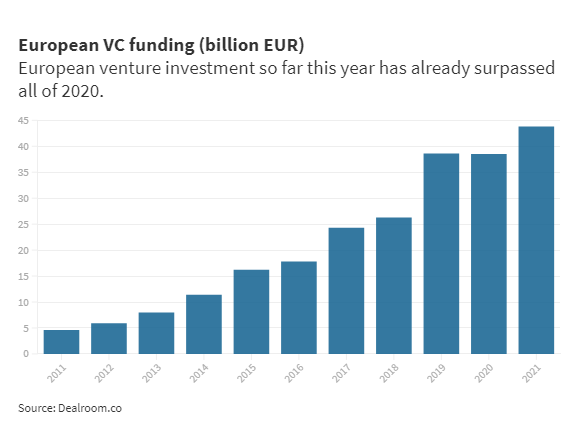

Europe’s tech sector has attracted more venture capital investment in 2021 than the previous year and start-ups in Europe raised €43.8 billion ($60.9 billion) in the first six months of 2021, according to CNBC.

The figures from Dealroom show easily surpassing the record €38.5 billion invested in 2020.

Dealroom which provides market intelligence to startups stated that despite the fact that the number of venture deals signed so far is around half the amount agreed in 2020 and about 2,700 funding rounds have been raised so far in 2021, versus 5,200 in 2020.

Swedish buy-now-pay-later firm, Klarna raised over $1.6 billion in two financing rounds in 2021 and German stock trading app, Trade Republic bagged $900 million in a May fundraise and British payments provider Checkout.com snapped up $450 million in January.

It suggests that European tech firms are pulling in far larger sums of money per investment than in previous years, defying the economic uncertainty of the coronavirus pandemic, which provided a big boost to online services.

French President Emmanuel Macron said on Tuesday that he wants to see the creation of at least 10 tech companies in Europe worth over €100 billion each by 2030. While Europe is now home to many unicorns — start-ups valued at over $1 billion — it is yet to produce a company with the scale of American and Chinese tech giants.

The number of $1 billion start-ups in Europe continues to grow, the number of exits in the continent is also increasing.