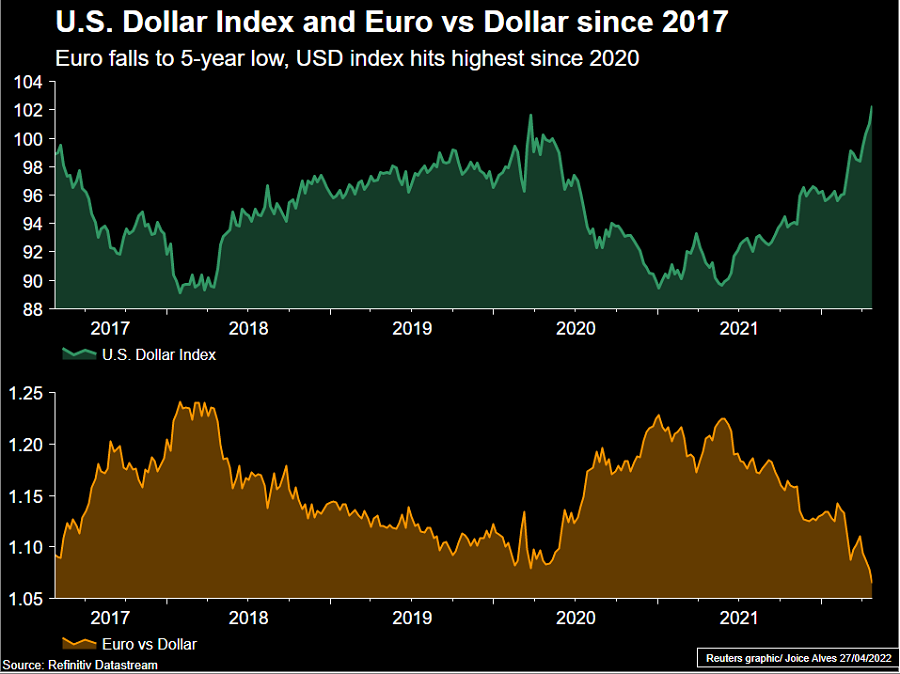

The euro fell below $1.06 for the first time in five years against a broadly strong U.S. dollar on Wednesday amid rising concerns around energy safety and growth slowdown in China and Europe, according to Reuters.

The euro slipped to a five-year low of $1.05860 after Russia’s Gazprom said it would cut gas supply to Poland and Bulgaria, as the crisis over Russia’s invasion of Ukraine deepened. It was 0.3% lower at $1.0607 at 1100 GMT.

The single currency has fallen more than 4% so far in April and is heading for its worst monthly loss in more than seven years as uncertainty around the war in Ukraine and China’s COVID lockdown measures led traders to ditch the euro in favour of the safe-haven dollar.

“Exaggerating the downside risk for euro/dollar have been the COVID lockdown fears for China,” said Jane Foley, Head of FX Strategy at Rabobank London.

Additionally, “fears over energy security in Europe have been hugely amplified by reports regarding the severing of Russian gas supplies to Poland,” she added.

Economic growth concerns are rising. Data showed consumer confidence in France, the euro zone’s second largest economy, fell more than expected in April.

In the meantime, the U.S. dollar index , which measures the greenback performance against a basket of six major currencies, rose 0.3% to 102.7, after touching its highest since the early days of the pandemic.

Also supporting the dollar index, traders wager that rates are going up faster in the United States than any other major economy.