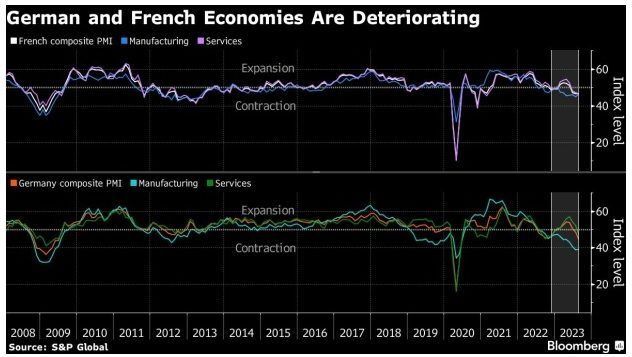

The contraction of private-sector activity in the euro area intensified in August as services ceased being a bright spot and followed the industrial sector into a downturn, according to Bloomberg.

The flash Purchasing Managers’ Index for the region fell to 47, further below the 50 threshold indicating growth and again a worse outcome than predicted by any economist in a Bloomberg survey. Services activity shrank for the first time since the end of last year, while the expectation was for continued expansion in a sector that had until recently seen robust demand.

The figures were particularly dire in Germany, where overall activity declined at the fastest pace since the first wave of the pandemic brought the economy to a screeching halt in May 2020. France reported a third monthly drop in output, while the rest of the region contracted more moderately.

“The service sector of the euro zone is unfortunately showing signs of turning down to match the poor performance of manufacturing,” Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said in a statement. “Service companies reported shrinking activity for the first time since the end of last year, while output in manufacturing dropped again.”

The figures indicate that the euro-area economy will shrink by 0.2% in the third quarter, compared with 0.3% growth in the three months through June, he said.

The report comes at a crucial moment for the European Central Bank, which is undecided between another rate increase in September and a pause. While slowing activity should support the latter outcome, the PMI report released by S&P Global on Wednesday also came with a warning over stubborn price pressures.

Headline rates of input cost and selling price inflation moved higher in August, partly due to wages, S&P Global said. The measures still signaled far lower pressures than seen over much of the past 2 1/2 years.

“ECB President Christine Lagarde sounded the alarm that the economy may be faced with higher wages and lower productivity, leading to higher inflation,” de la Rubia said. “It seems like those worries are about to turn into reality, at least for the vast service sector.”

There were also signs that the labor market, which has so far remained resilient against worsening economic prospects, is starting to feel the pinch. Hiring nearly stalled as companies confronted a gloomier outlook for the year ahead, S&P Global said.

Business confidence fell, largely driven by lower backlogs of work. Companies also cited concerns “over broader economic slowdowns at home and in export markets,” the report said.

Data for Germany and France earlier on Wednesday showed contractions. Earlier numbers from Australia pointed to a deepening slump, while a measure for Japan showed solid growth. UK numbers are likely to indicate slight expansion, while figures from the US are predicted to show stable growth.