Inflation in Romania accelerated to its fastest since 2018 as a political crisis sent the currency to a record low and complicated decision-making for the central bank, according to a Bloomberg report.

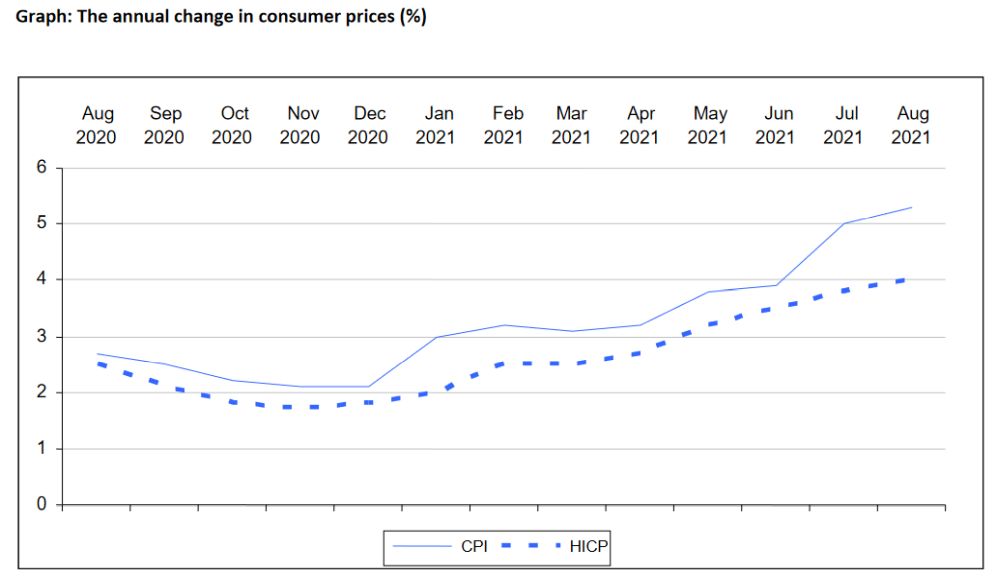

Data from the Statistics Institute have shown that consumer-price growth quickened to 5.25% from a year earlier in August, compared with 5% in July.

As higher energy tariffs trigger price increases across the board, the central bank has refrained from following Hungary and the Czech Republic in lifting borrowing costs, preferring instead to use money-market tools to curb liquidity.

While some board members still see the price shock as transitory, Governor has said interest-rate hikes are in sight, but only at the right time. Romania, like other parts of Eastern Europe, are bracing for a new wave of the pandemic.

The acceleration in price growth may not be done yet: inflation is expected to end the year at about 5.6%, according to the latest central bank forecast, only re-entering the 1.5%-3.5% target band in 2022

The weaker leu could continue to be a factor for prices, with the government facing a confidence vote that could topple Prime Minister Florin Citu.